The organisational needs of a company or organisation can change during its existence. These changes can occur within the existing structure or beyond its own structure.

Legal basis

To facilitate the latter, the legislator created the Federal Act on Mergers, Demergers, Transformations and Transfer of Assets (Merger Act, FusG, SR 221.301, no official translation in English) for Swiss companies. Although the law is called «Merger Act», it regulates not only mergers but all following reorganisations:

-

- Mergers

- Demergers

- Transformations

- Transfers of assets

These are even possible between different types of companies and organisations.

Merger

A merger is a contractually agreed amalgamation of two or more companies into one single company without liquidation. The entirety of the acquired company’s assets, liabilities, and legal relationships will be transferred into the acquiring company without the requirement of any specific legal acts causing such transfer. This is called the principle of universal succession. The shareholders of a transferred company receive (generally) participation rights of the acquiring company in exchange for their respective rights in the transferred, later dissolved company. This process follows the principle of continuity of membership.

There are two types of merger:

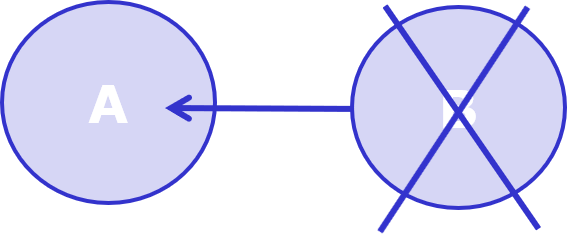

Merger of absorption

In this type of merger, one company (A) absorbs the other (or the others) (B), i.e. the absorbed company is deleted after the merger.

Merger of combination

In this type of merger two (or more) companies are contributed to a newly formed company and the previous companies are deleted.

The Merger Act makes this process relatively simple. However, it also creates risks for the shareholders of the merging companies, their creditors and employees. In order to eliminate these risks as far as possible, a merger must be carried out strictly according to a procedure laid down in the law.

-

- Merger agreement

- Merger report

- by management

- comment on all relevant points of the merger

- Audit

- by a licensed audit expert

- whether compensation payment is appropriate

- whether capital increase of the acquiring company is sufficient to preserve the rights of the shareholders of the transferred company

- Right of inspection

- of shareholders of involved companies

- Merger resolution

- Entry in the commercial register

In order to protect the rights of shareholders, creditors and employees, the legislator has granted them the following rights in the aforementioned proceedings:

-

- Shareholders

- provisions regarding continuity of membership

- requirement of qualified majority for the merger resolution

- right of action

- Creditors

- protection of existing claims

- merger must be publicly notified (→ Swiss Official Gazette of Commerce)

- right of action

- Employees

- employment relationship is transferred automatically

- right of information

- right of consultation

- continuous liability of former employer

- Shareholders

Demerger

A demerger is a mirror image of the reverse of a merger. This also applies to the legal requirements and the corresponding procedure. For this reason, reference is made to the previous explanations and remarks in this regard.

Similar to the merger, there are also two types of demerger:

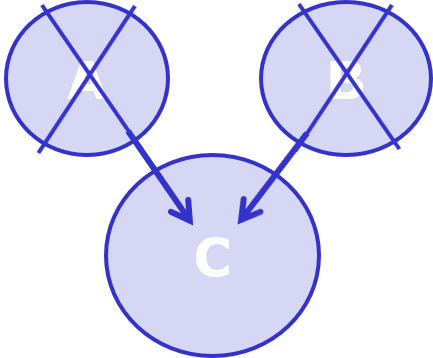

Split-off demerger (Ger.: Aufspaltung)

In a split-off demerger, a company (A) is split into two new companies (B and C), and the original split company (A) is then deleted.

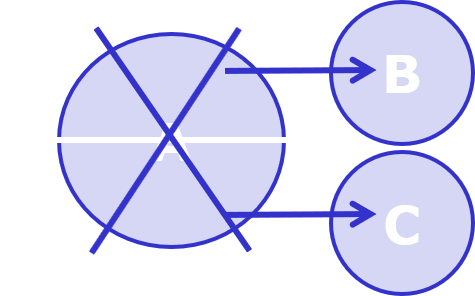

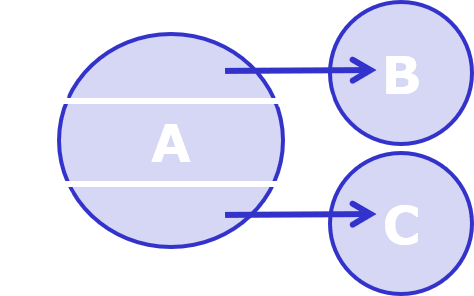

Spin-off demerger (Ger.: Abspaltung)

In a spin-off demerger, parts of a company (A) are transferred to third companies (B and C), whereby the transferring company (A) remains in existence without the transferred parts (B and C).

Transformation

The founders of a start-up in Switzerland regularly opt for the form of a limited liability company (LLC; s. Chapter 06.03 Closed number of companies) because they want to make a strong personal commitment and because they need relatively little capital to establish it. However, as soon as investors want to get involved in the start-up, the LLC is not suitable for this, because shares in the company can only be sold and bought with difficulty and because investors naturally do not want to become personally involved on a regular basis, especially not in a management position. At that moment the company should be transformed into a corporation (Corp.; s. Chapter 06.03 Closed number of companies). Before the introduction of the Merger Act, the LLC in Switzerland had to be dissolved and its assets and liabilities transferred to a newly founded corporation. This was very complicated and costly.

However, the transformation of one type of company into another type of company, based on the Merger Act, is now carried out in one step (universal; lat. «uno actu») and without liquidation of the original company. The assets and liabilities do not therefore have to be transferred. The identity of the company is preserved (principle of identity) and the old shareholders are also the new shareholders (principle of continuity of membership).

The transformation of a company or its form does generally follow the same procedure as in a merger (s. above). This means that the rights and claims of shareholders, creditors and employees are also protected in this act (s. above).

Transfer of assets

Finally, the Merger Act offers the possibility to transfer assets and liabilities of an entity to another entity in one act (universal; lat. «uno actu»). The transfer gets legally binding by registration in the commercial registry. In this case of the Merger Act is no element of membership like in a merger or transformation. The transferring entity and the acquirer are jointly and severally liable for transferred obligations of the transferring entity arising before the transfer of the assets.